Corporate Governance

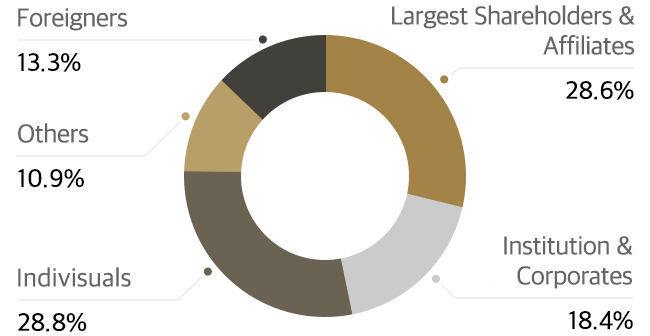

Share Ownership Structure

of Shinsegae Inc.

| Shareholders | Shares | Ownership(%) |

|---|---|---|

| Largest Shareholder & Affiliates | 2,813,184 | 28.6 |

| Foreigners | 1,311,769 | 13.3 |

| Institution & Corporates | 1,815,910 | 18.4 |

| Indivisuals | 2,826,818 | 28.7 |

| Others | 1,077,500 | 10.9 |

| Total | 9,845,181 | 100.0 |

Major Shareholders

(more than 5% ownership)

| Name | Number of Shares | Percentage of Shares(%) |

|---|---|---|

| Chung, Yoo Kyung | 1,827,521 | 18.6 |

| National Pension Service | 1,019,127 | 10.4 |

| Lee, Myung Hee | 984,518 | 10.0 |

| Total | 3,831,166 | 38.9 |

Profile of Directors

-

Park, Joo Hyungk

CEO, Shinsegae Inc

Former Executive Vice President, Shinsegae Support division

CEO, Shinsegae Central Inc. & Seoul Express Bus Terminal

-

Kim, Sun Jin

Executive Vice President of Sales Division & Gangnam Store, Shinsegae Inc

Former Executive Vice President of Merchandise Division, Shinsegae Inc

Former Executive Vice President of Gangnam Store, Shinsegae Inc

-

Hong, Seung Oh

Executive Vice President of

Support Division, Shinsegae IncFormer Executive Vice President of Strategy&Finance, Shinsegae Inc

Former Executive Vice President of Planning&Management, Shinsegae Inc

-

Choi Nan Sul Hun

Professor of Law at Yonsei University

Fair Trade Commission, Fair trade Policy Advisory Committee

Financial Services Commison, Legal Advisory Committee

-

Kwag, Se Boong

Kim&Chang Senior Advisor

Former Commissioner of Korea Fair Trade Commission

Former Director General of Competition Policy Bureau, Korea Fair Trade Commission

-

Kim, Han Youn

We Know Tax Senior Advisor

Former Director of Investigation 1 at the Seoul Regional Tax Office

Former Head of National Tax Service Busan Regional

-

Jin, Hee Seon

Bae, Kim & Lee LLC Senior Advisor

Former Vice-Mayor, Administrative Affairs II, Seoul Metropolitan Government

Former Head, Urban Restoration HQ, Seoul Metropolitan Government

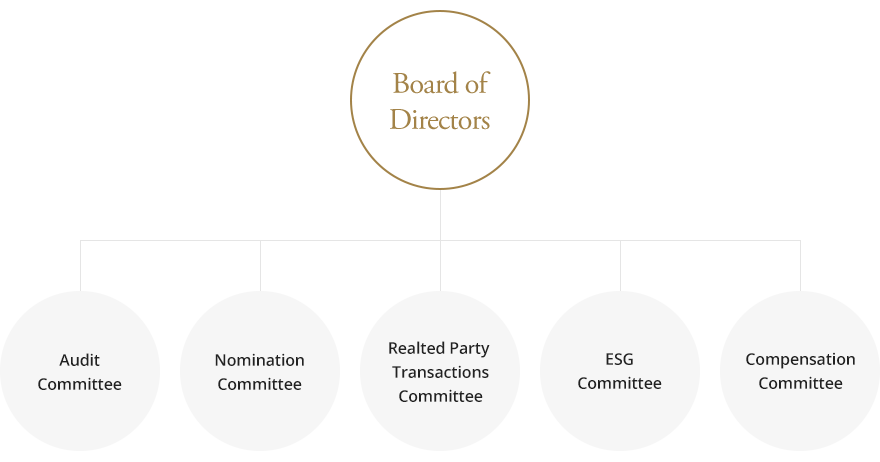

Directors

- Audit

Committee - Nomination

Committee - Related Party

Transactions

Committee - Committee

Audit Committee

Function : Auditing & Report on Operations &Audit for operations of directors

| Position | Name | Term of office | Date of appointment |

|---|---|---|---|

| Outside Director | Kim , Han Youn | 2Years | 2025. 03 |

| Outside Director | Jin, Hee Seon | 2Years | 2025. 03 |

| Outside Director | Choi, Nan Sul Hun | 2Years | 2024. 03 |

Nomination Committee

Function : Recommend candidates foroutside director

| Position | Name | Term of office | Date of appointment |

|---|---|---|---|

| Management | Park, Joo Hyung | 3Years | 2024. 03 |

| Management | Hong, Seung Oh | 3Years | 2023. 03 |

| Outside Director | Kwag, Se Boong | 2Years | 2025. 03 |

| Outside Director | Jin, Hee Seon | 2Years | 2025. 03 |

| Outside Director | Choi, Nan Sul Hun | 2Years | 2024. 03 |

Related Party Transactions Committee

Function : Evaluate & Approve Internal Transaction| Position | Name | Term of office | Date of appointment |

|---|---|---|---|

| Management | Hong, Seung Oh | 3Years | 2023. 03 |

| Outside Director | Choi, Nan Sul Hun | 2Years | 2024. 03 |

| Outside Director | Kim, Han Youn | 2Years | 2025. 03 |

ESG Committee

| Position | Name | Term of office | Date of appointment |

|---|---|---|---|

| Management | Hong, Seung Oh | 3Years | 2023.03 |

| Outside Director | Jin, Hee Seon | 2Years | 2025.03 |

| Outside Director | Kwag, Se Boong | 2Years | 2024.03 |

Compensation Committee

| Position | Name | Term of office | Date of appointment |

|---|---|---|---|

| Management | Hong, Seung Oh | 3Years | 2023. 03 |

| Outside Director | Kwag, Se Boong | 2Years | 2025. 03 |

| Outside Director | Kim, Han Youn | 2Years | 2025. 03 |

Payout Policy

We will strengthen shareholder-friendly management by establishing an objective and predictable dividend policy.| Treasury Stock | · FY2025-FY2027 : Cancellation of above 200,000 share(2%) of treasury stock each year |

| Dividend | · FY2025-FY2027 : Gradual increase in dividends per share by over 30% |

| Minimuim Dividend | · FY2024-FY2027 : Minimuim dividend per share of KRW 4,000 won |

| Period | · This shareholder return policy will remain in effect through the 2027 fiscal year to improve shareholder predictability and will be reviewed in 2028 |